Binary Options Vs CFD Trading - Key Differences And Similarities

Confused about which one to choose, then know the differences and similarities between Binary options vs CFD trading. If you are still stuck in your initial step, this article is just a perfect piece for you.

Including other differences, binary options offer fixed returns but limited risk, while CFDs allow for greater flexibility in position sizing and potentially higher profits but with increased risk.

The article will illustrate the similarities and differences between the two popular trading forms. Trading with one is simple, whereas the other is a roller coaster ride. But both binary options and CFD trading allow traders to speculate on the price movements of underlying assets.

Let’s have a smooth journey with us!

What Is Binary Options?

You might have that feeling, trading binary options is like shooting an arrow in the dark; you may end up hitting your target, but you can’t be sure if you will. On the other hand, binary options or digital options can also be seen as a way to take advantage of market movements. By correctly predicting which way the market will move, traders can make a profit even if the market doesn’t move very much.

So, this is the beauty of binary options.

It is a financial exotic option or derivative that pays you a fixed monetary reward if your prediction is correct. But if your prediction is wrong, you could lose your shirt!

For example, suppose you choose to trade options on the Gold/USD pair. Select the timeframe and predict whether the price of the asset will move up or down. If your prediction turns out right, you will get a fixed reward. There’s no money if you’re wrong.

However, experts recommend analyzing the market accurately. Because the probability of losing money on a binary option is high, some estimates suggest that as many as 70-90% of traders lose money.

But on the other hand, we got many successful names who traded this form and became a millionaire. Though losing money is common in trading. So, if you lose money, you can always tell your friends you’re on your way to becoming the next binary options millionaire!

So the overall binary options from the drop-down menu:

- Binary options trading depends on two outcomes Yes or No

- It is a derivative

- You need to set a certain expiration period

- Binary trading has fixed payout and rewards

- There are so many binary options trading types

Features Of Binary Options:

Binary options trading provides traders with a high degree of flexibility, allowing them to take profits quickly while also holding positions longer. The fact that traders can trade multiple markets at once can also help reduce risk by diversifying their portfolios.

The trading type is alluring because of the following features:

- Binary options trading is best for day traders or short-term traders

- Offer fixed payout ratio

- Have an expiry date

- Small investment facility

- Lower risk compared to the other trading forms

- No need to own any asset

Is Binary Trading Legal In All Countries?

Binary options trading is not legal in many countries. However, a few countries, like the USA, do not support traders or investors to trade options. But there are no strong legal boundaries. In many countries, there aren’t clear laws regulating binary options trading because they’re still evolving.

Because of this, it’s challenging for governments to enforce any regulations. In other words, if you want to trade binary options, you’re pretty much on your own!

There are always offshore brokers with wide arms if you’re still ready to trade.

What Are The Advantages Of Binary Trading?

Binary options trading has tremendous benefits, especially for short-term traders. It is a simple trading method than other complex forms. But don’t forget – it can also be a bit of a prediction game, so always double-check your position before you hit the “trade” button, or you might regret it!

Though you will find different types of options, the traditional form is a little different from the digital options. But the advantages that you will get are similar.

Let’s have a look at the following advantages of Binary options trading:

- Simple trading form

- Fast and high returns

- You can set the trade expiration time

- Fixed payout

- No overnight fees or spread

- Transparent reward percentage

- Trade on multiple assets to diversify the portfolio

- Low initial deposit

With all the advantages, binary trading is now more trader’s centric.

What Is CFDs Trading?

CFDs which stand for contracts for difference is a derivative with multiple benefits. It is an agreement between the broker and the trader. At the end of the contract, a trader exchanges the difference between the asset’s opening and closing price. There are two outcomes:

- The seller pays the buyer if your prediction goes right or the change is positive.

- If the prediction goes the opposite, the buyer loses everything.

Let’s say you decide to buy 50 stocks for $10 each. According to the prediction, you choose to open a sell position. The margin for the trade is 5%.

In other words, you’re paying 5% of the total transaction cost of $50 (0.05 x $10 x 100). As there is no expiration period, the very next month, the price rises to $25, and you choose to close the deal.

So, with an investment of $50, you are earning a profit of $1,450!

Now let’s see what happens when the situation is reversed. You would set a stop loss at $8 if the market moved in the opposite direction.

Now, the price has fallen below $10, and the stop loss is triggered at $8. The result of this trade is that you would’ve lost $200 ($1000- $800).

The most attractive option is that you don’t have to own any physical assets. On the other hand, you will have the opportunity to use the leverage that allows traders to increase their returns. So, eventually, you will invest a small percentage in opening a big position.

However, it is important to note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. According to some estimates, around 73% of retail investors lose money when trading CFDs. So, in other words, if you’re a CFD trader, you have a 73% chance of ending up with a lighter wallet!

However, it doesn’t mean you won’t be a profitable giant. You will. But it is important to be aware of the risks. In order to be fortunate, you must implement strategies clearly.

So, the key takeaways are:

- CFDs trading is a contract between buyer and seller

- Margin or leverage trading is available

- No expiration period

- Stop-loss options to save your investment

Features Of CFD Trading:

So, the features of CFDs trading make this popular form of trade different from others. CFD trading is like a roller coaster; it has ups and downs. With the potential for sharp turns and fast movements, it can also be exciting and rewarding if you know what you are doing.

But if you don’t know what you’re doing, it can also be a wild ride! Just make sure you buckle up and hold on tight!

So, the following features make CFD trading different from others:

- CFDs trading does not require owning a trading asset

- You can trade using leverage and margin

- Has no expiration period

- Stop-loss facility to low down the risk

- Charges overnight fees

Is CFD Trading Legal In All Countries?

Just like binary options, trading CFDs is illegal in many countries. However, this trading form is not legally abode by any regulatory bodies. If you are keen to trade, offshore traders based on your location are always available to serve.

But it is recommended to review the broker properly before putting your money. Regulated brokers will always give you financial protection. That’s right; your money is safe. But not from the broker’s fees!

So, you can still trade this form.

Advantages Of CFD Trading:

Will you find any trading form that has no advantages? Unfortunately, no. They all have at least one advantage: it’s easier to trade with them than with your neighbour’s pet parrot.

CFD trading also has some advantages, which you should note for future reference. Who knows, these words may inspire you to trade well.

The following benefits of CFD trading are:

- Derivative, so you don’t need to own trading assets

- No expiration date

- Earning potential from both the bear and bull market

- Option to control risk

- Leverage trading

- Trade on multiple trading instruments

- No stamp fees

Similarities - Binary Options Vs CFD Trading:

Any form of trading will give you a different experience. Unless you trade your siblings, then the experience will be the same!

CFDs and binary options trading have some similarities. Despite the potential profits, both trading forms carry high levels of financial risk.

Let’s list those mirror points of binary options trading and CFD trading:

- Both forms of derivative trading mean traders do not own the underlying asset.

- Allow traders to make profits from the price movement of financial markets.

- Both types of trading are online-based through a broker or trading platform.

- Binary options and CFDs can both be used to make profits in a rising or falling market.

Differences - Binary Options Vs CFD Trading:

What makes one better than the other? Do you think differences make one better? The real scenario is completely the opposite on the financial ground. Both trading forms are equally profitable if you know the tricks.

At the same time, they differ in terms of the payout structure, expiry time, trading style, regulation, leverage, etc.

1. Risk and reward:

You will get to know the risk measurement before the trade in Binary options. In CFD trading, the potential profit or loss is fixed. It can change anytime, depending on the underlying asset’s price movement.

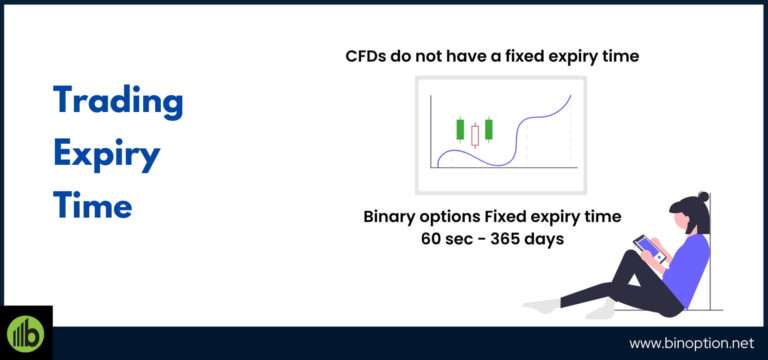

2. Expiry time:

Binary trading is absolutely perfect for short-term traders. And about expiration time, this trading form has a fixed expiry time, from 60 seconds to 365 days. On the other hand, CFDs do not have a fixed expiry time and can be held for as long as the trader wishes.

3. Underlying assets:

Though binary trading allows you to trade on multiple assets, but typically has a limited range, such as currency pairs, stocks, and indices. Conversely, CFDs can be used to trade a much more comprehensive range of underlying assets.

4. Accessibility:

Binary options are typically only offered by a few select brokers, while a wide range of brokers offers CFD trading.

5. Regulation:

Binary trading is often not regulated, while financial authorities typically regulate CFD trading. Yes, you will have the opportunity to perform trade through regulated brokers.

6. Trading style:

Options trading is typically the most accessible form of trading. On the other hand, CFD is considered an advanced form of trading.

7. Leverage:

In CFDs, you can trade on leverage to control a large position with a relatively small amount of capital. On the flip side, options won’t allow you to enjoy this privilege.

8. Risk management:

To manage your trading risk, CFD trading allows traders to set stop-loss and take-profit orders. This option can limit potential losses and lock in profits. Digital options trading does not have these features.

The following differences will help you to identify which form is just fine for you to start initially.

Final Words:

In conclusion, the heaviest words are that, between binary options vs cfd trading no matter which trading form you choose to trade, plan and analyze the market before opening your position. The financial market changes colours within a blink. So, if you miss anything important, you will face the consequences.

Binoption is not a financial adviser. So, whatever you choose, choose wisely.